April 18, 2022

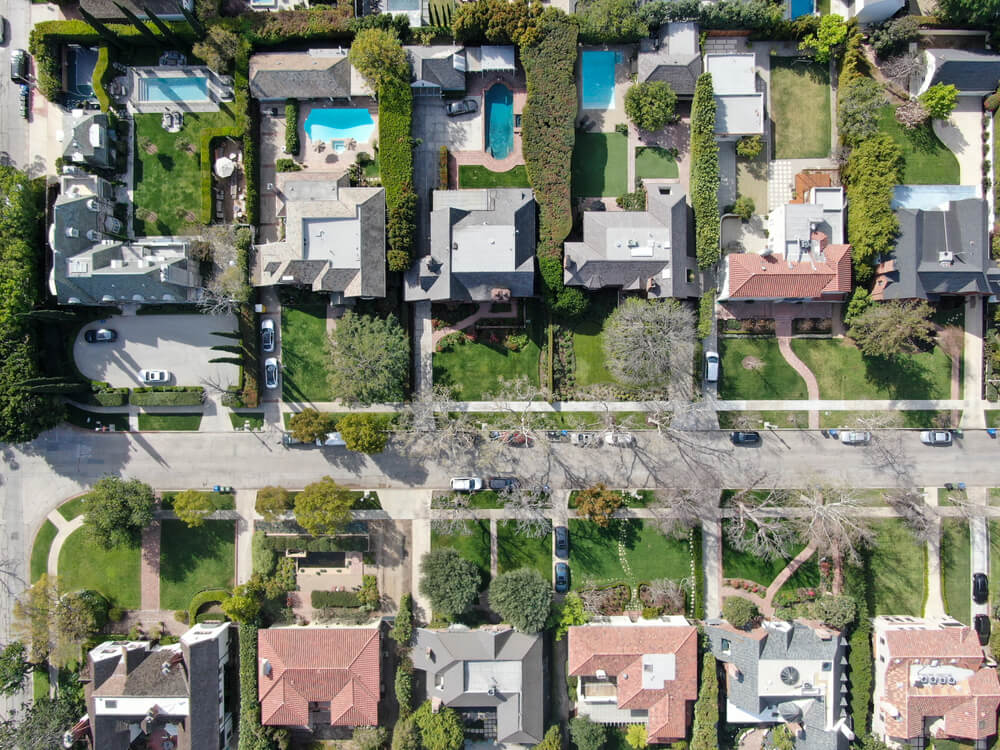

It’s hard to beat having your own little oasis in your backyard in the form of a pool. The fact is, however, that when it comes to carrying homeowners insurance, you need to address the matter of your pool.

In the eyes of the law, you have a general duty to appropriately maintain your property in terms of your guests’ safety, and this includes your pool.

This is a matter that your homeowners insurance should address directly, and a reputable California homeowners insurance agency can help you with that.

While the State of California does not require you to carry homeowners insurance, your mortgage provider almost certainly does.

If you own a pool, the liability involved is far too great not to address the matter in your homeowners policy.

The liability portion of your policy addresses any medical expenses or lawsuits that stem from any pool-related incidents or accidents (you and your household, however, are excluded from this coverage).

California no longer adheres to the attractive nuisance view of swimming pools.

Attractive nuisance refers to something that is known to attract children and that homeowners are required to directly address in terms of their liability.

Liability does require homeowners to maintain their homes in a manner that allows for their guests’ reasonable safety, which means that homeowners bear considerable liability, and having a homeowners insurance that is up to the task is paramount.

Note that virtually every city and town in California has specific fencing requirements related to keeping uninvited guests (including children who may wander in) out.

This liability is very real, and discussing your insurance requirements as they relate to your pool with a trusted homeowners insurance agent is the best path forward.

The following factors can affect home insurance costs as they relate to your pool:

An experienced homeowners insurance agent can help you maximize your coverage in relation to your needs while helping to manage the cost increase your experience.

California homeowners insurance agents at Panorama Insurance Agency understand your pool-related insurance concerns with the insight and experience to help. Contact us for more information today. Call: 818-781-6630

Protect what matters most.

Home, Auto, Business & More.

Company

Contact

Panorama Insurance Agency 19302 Citronia Street Northridge, California 91324